‘Living paycheck to paycheck is a choice, not a mandate.’ This bold statement might stir up a mix of emotions. Especially if you’re among the 70% of recent graduates caught in this relentless cycle.

But here’s the truth: You can step out of this financial quicksand and into a world where bills are paid on time. It’s entirely within your grasp.

It doesn’t require a windfall or a miracle. A clear, actionable plan starts with a deep dive into your finances. It includes a budget that fits perfectly and a new understanding of your debts.

We’re cutting through the noise to show you how to break free from the paycheck-to-paycheck life. By the end of this guide, you’ll have a blueprint for financial stability. You’ll also have the tools to make timely bill payments a non-negotiable part of your life.

Stick with us as we reveal the actionable steps you can take today. Ensure your financial wellbeing isn’t just a goal but a reality. Starting now, you’ll walk away with concrete methods to reshape your financial future.

Key Takeaways

- Establish a budget to prioritize essentials. Cut unnecessary expenses to ensure timely bill payments.

- Build an emergency fund to avoid financial crises and reduce reliance on debt.

- Explore additional income streams through hobbies, skills, or part-time work. This will increase financial flexibility.

- Use debt reduction strategies. For example, the avalanche or snowball methods can help you manage and eliminate debt efficiently.

Assess Your Finances

Before taking control of your finances, you need to set clear financial goals. Determine your goal first, such as saving for paying off debt, an emergency fund, or a big purchase.

Specific targets will guide your financial decisions and keep you focused on your priorities.

Set Financial Goals

Establishing a strong financial base is crucial to secure your future and achieve your dreams.

This applies to embarking on globetrotting adventures, making a significant investment, or simply enjoying a life free from the constraints of living paycheck to paycheck.

For those in the U.S. and worldwide, setting financial goals requires a strategic approach that’s understandable regardless of your native language. Here’s how you can embark on this journey:

Evaluate Your Financial Landscape: Begin by comprehensively understanding your financial inflow and outflow. This means taking stock of all income sources. Then, juxtapose them against your monthly expenses. It’s a foundational step that brings clarity to your financial health.

Confront Your Debt Head-On. Acknowledging the extent of your debt is a pivotal moment in your journey towards financial liberation. It’s about facing the reality of your obligations and formulating a plan to navigate out of debt. This will set the stage for a secure financial future.

Forge Your Safety Net: Establishing an emergency fund can’t be overstated. In life’s unpredictable journey, having a financial cushion equates to peace of mind. Start with attainable objectives, like saving for unforeseen expenses and fortifying economic resilience.

Envision Your Financial Aspirations: Keeping a clear image of your financial aims can be a powerful motivator. You move forward by staying focused on your goals. Whether it’s freedom from financial worries or achieving personal dreams.

Embarking on the path to financial security isn’t just about crunching numbers. It’s also about crafting a roadmap to liberation and fulfillment.

Use a strategic approach informed by a clear understanding of your financial state. With it, you can confront debts, build an emergency buffer, and focus on your aspirations.

This way, financial freedom is within reach. This journey demands patience, discipline, and an unwavering commitment to your goals. But the rewards are immeasurably worth it: peace of mind, security, and the ability to pursue your dreams.

Creating a Personal Budget

You must create a personal budget. This is particularly true after graduating from college.

This process involves understanding your income sources. It also involves managing expenditures effectively and establishing a foundation for financial security. Here are practical steps to embark on this journey:

To begin, juxtapose your earnings against your outgoings. This simple visual aid is effective. It will illuminate the flow of your finances. This makes it easier to pinpoint opportunities for savings or debt minimization.

It’s crucial to treat your budget as a dynamic tool that evolves as your financial circumstances transform.

The initial step should always involve scrutinizing your expenses for potential cuts. This approach does not necessitate sacrificing your happiness; it’s about identifying and prioritizing expenditures that hold genuine value to you. Fine-tune your budget over time.

Remain open to exploring new ways to increase your income. You can make a significant difference in your income by freelancing or selling items you no longer need.

The goal in crafting this guide was to present the information clearly and concisely. It is suitable for a global audience, including those for whom English might not be their first language.

This guide aims to demystify budgeting. It offers straightforward strategies for managing your finances.

Understanding and Managing Debt

It is essential to navigate the complexities of debt management for achieving financial wellbeing after college. It marks the path away from living paycheck to paycheck and toward financial freedom. This guide presents practical strategies for tackling debt:

1. Employ the Debt Snowball Technique

Start with your smallest debts. Dedicate as much payment as possible to these. Keep making minimum payments on your more significant debts. As you eliminate each smaller debt, use the funds you were paying on that debt to contribute to the next smallest.

This approach helps you systematically reduce your debt. It also provides motivational wins along the way.

2. Prioritize High-Interest Debts

It’s critical to focus on debts with high interest rates. Certain debts, such as credit cards and personal loans, have high-interest rates. These debts can significantly slow your financial progress due to the compounding interest costs.

By addressing these first, you can save money in the long run.

3. Consider Refinancing and Consolidation

Look into refinancing options that may lower the interest rates on your current debts. Additionally, consolidating multiple debts into one loan with a lower interest rate can streamline your payments.

This makes them easier to manage. This can result in significant savings and make repaying debt easier.

4. Explore Loan Assistance Programs

Investigate if you’re eligible for any loan assistance programs, particularly for student loans. After meeting specific criteria, these programs can offer reduced payments or even loan forgiveness. They can be a lifeline for managing and eventually overcoming student debt.

Understanding and managing debt is more than just paying bills. It’s about making strategic choices that pave the way to financial independence.

Remember, managing debt is a journey, and every step towards reduction is a step towards freedom.

Start an Emergency Fund

Creating an emergency fund is a pivotal step after graduating from college. It helps establish a robust financial base. This initiative goes beyond simply crafting a financial safety net. It’s about carving a path towards economic liberation.

Avoiding living paycheck to paycheck reduces worry and opens doors for increasing income and pursuing your dreams without fearing financial emergencies influencing every decision.

Setting Achievable Goals: Set a realistic and achievable goal for your emergency fund to begin this journey.

Starting with a target of $1,000 is advisable. This initial milestone is both achievable and significant enough to cover minor unforeseen expenses, acting as a buffer that can prevent you from sliding into debt during emergencies.

Managing Your Cash Flow Wisely A meticulous approach to managing your finances is crucial. Monitor your spending closely to understand precisely where your money is going.

This insight allows you to identify and eliminate unnecessary expenditures, freeing up more funds to contribute to your emergency savings. Managing your cash flow is a discipline. It helps build your emergency fund. It fosters healthy financial habits.

These habits benefit all aspects of your economic life.

Ensuring financial security is invaluable. Knowing you have the resources to handle unexpected expenses brings tranquility. It prevents resorting to debt. Build an emergency fund to give peace of mind and confidently navigate uncertainties.

Establish an emergency fund to shield yourself from sudden financial demands. This will also liberate your cash flow for more exciting prospects.

Whether your goals are traveling, pursuing more education, or starting a business, having an emergency fund ensures you’re better equipped to seize opportunities to boost your income through investments, side hustles, or career progression.

Remember, each dollar saved brings you closer to financial independence. It also fortifies your financial security.

Smart Spending and Saving Habits

Building smart financial habits is crucial for achieving stability after college. These habits also help you aim for a life of freedom, not just from debt, but also to live according to your own rules. Here are some effective strategies to pave the way:

- Monitor and Reduce Expenses: Start by closely monitoring every dollar you spend. Pinpoint areas where you can scale back without compromising your lifestyle. This could involve reducing costly habits or finding more affordable alternatives to your priciest subscriptions.

- Boost Your Earnings: Explore opportunities to increase your income through additional projects, freelance work, or part-time employment. Your talents are invaluable, and tapping into them can help break the cycle of living from one paycheck to the next.

- Optimize Your Spending: Allocate your funds wisely, focusing on necessities while removing non-essential expenditures. It’s all about ensuring your money serves you well rather than just disappearing without benefiting you in the long run.

- Tackle Your Debt: Make it a priority to pay off debts with high-interest rates as swiftly as possible. Look into strategies like the debt snowball or avalanche methods for a structured approach to becoming debt-free.

Crafting a life of financial freedom post-college begins with these foundational steps. By attentively managing your expenses, seeking additional income sources, smartly allocating your funds, and addressing debts head-on, you’ll be well on your way to a more secure financial future.

Investing in Your Future to Stop Living Paycheck to Paycheck

Investing in Your Future: A Comprehensive Guide for Global Citizens

In today’s fast-paced world, achieving financial stability is just the beginning. The real journey starts when you aim to transform this stability into lasting wealth.

Investment is a powerful tool in this endeavor, extending far beyond stocks and bonds. It’s about making your money work for you, ensuring you thrive, not just survive.

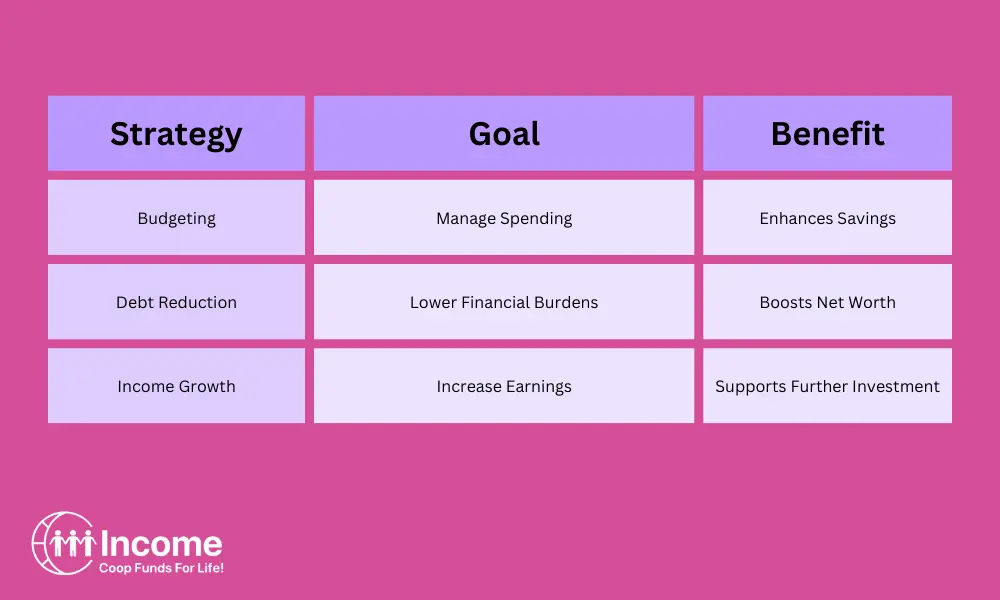

Let’s start with budgeting. Often misunderstood as a limitation, budgeting offers financial liberation. By tracking every dollar, you uncover hidden opportunities to save and subsequently invest. It’s the cornerstone of a sound financial plan.

Moving on to debt reduction, this strategy is pivotal for eliminating what you owe and liberating a significant portion of your income. This newfound financial freedom can then be channeled into investments that promise long-term growth.

Lastly, we focus on income growth. This could mean negotiating a higher salary, exploring side gigs, or upskilling. An increase in income enhances your lifestyle and provides additional means for investment.

Breaking free from the paycheck-to-paycheck cycle is within your grasp. By investing today, you pave the way for a future where financial stability evolves into enduring wealth.

This journey requires patience, strategy, and a bit of savvy, but the rewards are well worth the effort. Remember, the goal is to ensure that your money is saved and grows, securing a prosperous future for you and your loved ones.

Start your investment journey today. Witness the transformative power of smart financial decisions.

Is it normal to live paycheck to paycheck in your 20s?

Living paycheck to paycheck during your 20s is a reality many individuals across the globe face. This period often marks a journey towards achieving financial stability, which may seem like a far-off goal for some. However, it’s important to recognize that this stage of financial uncertainty isn’t set in stone.

In your 20s, take steps to begin securing your financial future. You can leave behind the constant stress of making ends meet.

Here’s how you can begin to change your financial situation:

- Create a Budget: Understanding how you spend money is the first step towards financial freedom. Take the time to monitor your expenses closely, categorizing them to see where your money is going. This will give you a clear picture of your spending on necessities versus luxuries.

- Eliminate Non-Essential Spending: Once you clearly understand your spending habits, it’s time to scrutinize them. Do you really need every subscription service you’re currently paying for? Focus on what’s essential and eliminate expenses that aren’t adding significant value to your life.

- Increase Your Earnings: Search for ways to boost your income. Consider asking for a raise, taking on freelance gigs, or launching a side project.

- A slight increase in income can increase your ability to manage your finances.

- Start an emergency fund. It’s crucial to set aside a portion of your income for emergencies. No matter how small the amount may initially be. Having a financial buffer can significantly reduce the stress associated with unexpected expenses.

By using these strategies, you can break the cycle of living paycheck to paycheck. Remember, the goal isn’t just to survive but to flourish financially.

Create a solid financial future with dedication and discipline.

This will allow you to enjoy your 20s without worrying about financial instability.

Achieving financial stability is a journey. At first, it may seem challenging. However, taking proactive steps can give you greater security and peace of mind.

Keep focused on your goals, and don’t hesitate to seek advice or resources to help you along the way. Your future self will thank you for the effort you put in today.

Frequently Asked Questions

How can recent graduates effectively negotiate higher salaries or benefits? This can help them avoid living paycheck to paycheck.

You must confidently negotiate higher salaries or better benefits to avoid living paycheck to paycheck. Start by researching average wages in your field to know your worth.

Then, clearly articulate your skills and achievements during negotiations. Don’t shy away from asking for what you deserve. Remember, benefits like remote work or flexible hours can also add value.

Stand firm but be open to compromise. This approach could significantly improve your financial situation.

What Role Does Mental Health Play in Managing Finances and Breaking the Paycheck-To-Paycheck Cycle for Recent Graduates?

Your mental health directly impacts your financial decisions, playing a key role in breaking the paycheck-to-paycheck cycle. It affects your motivation, decision-making, and stress levels, making planning and sticking to a budget harder.

How can recent graduates navigate financial uncertainties, such as fluctuating job markets or unexpected layoffs? They’re also trying to establish financial stability.

To navigate financial uncertainties, start by building an emergency fund. It’s your safety net against unpredictable job markets or sudden layoffs. Cut unnecessary expenses and consider side hustles to boost your income.

Prioritize your spending on essentials like housing and food. Always look for better job opportunities or ways to upscale your skills.

In What Ways Can Social Pressures to Maintain a Certain Lifestyle Impact a Recent Graduate’s Ability to Move Away From Paycheck-To-Paycheck Living?

Social pressures can really impact your financial health. They tempt you to live beyond your means to keep up appearances.

It’s tempting to overspend on the newest tech or fashion trends because they’re popular.

But remember, this can hold you back from breaking the paycheck-to-paycheck cycle. Instead, focus on what’s truly important and necessary.

Cutting back doesn’t mean missing out; it’s about prioritizing your financial freedom and stability.

Are there specific strategies recent graduates should use to manage and reduce student loan debt? Should they also consider their other financial goals?

You should tackle your student loan debt head-on while pursuing other financial goals. Start by understanding your loan’s terms and consider refinancing for lower rates.

Prioritize payments based on interest rates using methods like the debt avalanche. Remember to explore forgiveness programs if you’re eligible.

Simultaneously, cut unnecessary expenses and boost your income. This balanced approach lets you chip away at debt while building a secure financial future.

Conclusion

Do you want to join the ranks of success and make millions? Imagine not worrying about bills or living paycheck to paycheck. You can achieve this by completing just 3 steps once. It’s simple, clear, and can change your financial future. Here’s how:

- Step 1: Sign up to be a CoopInc Affiliate Member. This is your first step towards success.

- Step 2: Get 3 or more people to sign up as CoopInc Affiliate Members. This helps them and puts you in a position to start earning.

- Step 3: Encourage your 3 (or more) signed-up friends to do the same. This action unlocks your potential to earn the maximum royalties.

Following these steps means you’re on your way to financial independence and saying goodbye to financial stress. It’s about making smart choices and taking action now.

Start today, and see where this journey can take you!