Income-based loans could be your financial game-changer. They are tailor-made to your income, ensuring repayments don’t outpace your financial growth.

Built with the focus on your ability to repay, these loans are a solid strategy for those with minimal credit or those wishing to enhance their credit score.

By the end of this, you will understand how income-based loans differ from traditional loans. This knowledge will empower you to make informed decisions.

It’s a strategy to select the right personal loan that aligns with your income level and financial goals.

And that’s the key to transforming your financial landscape.

Key Takeaways

- Income-based loans are a viable option for borrowers with minimal credit history or bad credit, as they primarily consider the borrower’s income and ability to repay the loan.

- These loans may not require a credit check or only do a soft inquiry, making them more accessible to those with lower credit scores.

- Income-based loans typically have higher interest rates and shorter repayment terms compared to traditional loans, and they are usually for smaller amounts.

- Loans based on salary focus on the borrower’s ability to afford the repayment, but they can be expensive with high rates and potentially trap borrowers in a debt cycle.

Understanding Income-Based Loans

Income-based loans are like a helping hand for people who don’t have a good credit history. These loans, like income-based personal loans, are perfect if you want to control your money better but your credit score isn’t great.

The main idea is simple: lenders look at how much money you make and compare it to your debts to see if you can get a loan. This way, they don’t say no just because of your past, but they look at your current financial situation.

To get this type of loan, you must make a certain amount of money. Each lender has a different amount you must make. But it’s important because it shows you can handle the loan.

The way you pay back the loan is also based on your financial situation. This helps make the monthly payments more manageable and helps you pay off your debt without feeling overwhelmed.

Key Differences: Traditional Vs. Personal Loans Based on Income

Traditional loans and income-based personal loans are different. This is important to know when you want to borrow money. Traditional loans look at your credit score. This or minimum credit score can decide if you get a good loan or if you get denied.

On the other hand, income-based loans are more about how much money you make. They look at your other income-based loans work, and job to make sure you can pay back the loan.

Income-based personal loans can be a good choice if you make steady money but have a bad credit score. These loans look at how much you make and if your job is stable to decide if you can pay them back. This can help you get money that you mightn’t be able to get with other payday loans though.

But, it’s important to understand the terms of the traditional personal loan too. Traditional loans might let you pay back over a longer time and have lower interest rates if your credit score is good. Income-based personal loans might be easier to get, but they could have higher interest rates and shorter times to pay back. This is something to think about.

You need to balance the easy access to money with how much it costs to borrow. You want to find a loan that helps you grow financially and gives you freedom.

Choosing the Right Personal Loan for Your Income Level

When you’re eyeing a personal Income-based loans, it’s crucial to weight how it fits with your income.

You’ll want to align the loan with your paycheck, ensuring you don’t overextend yourself financially.

Navigating your options wisely can lead to a loan agreement that supports your financial growth without adding undue stress.

Evaluating Personal Loans in the Context of Income

Picking the right personal loan for your income can be a puzzle. Let’s simplify it by understanding different types of loans and how they fit your wallet.

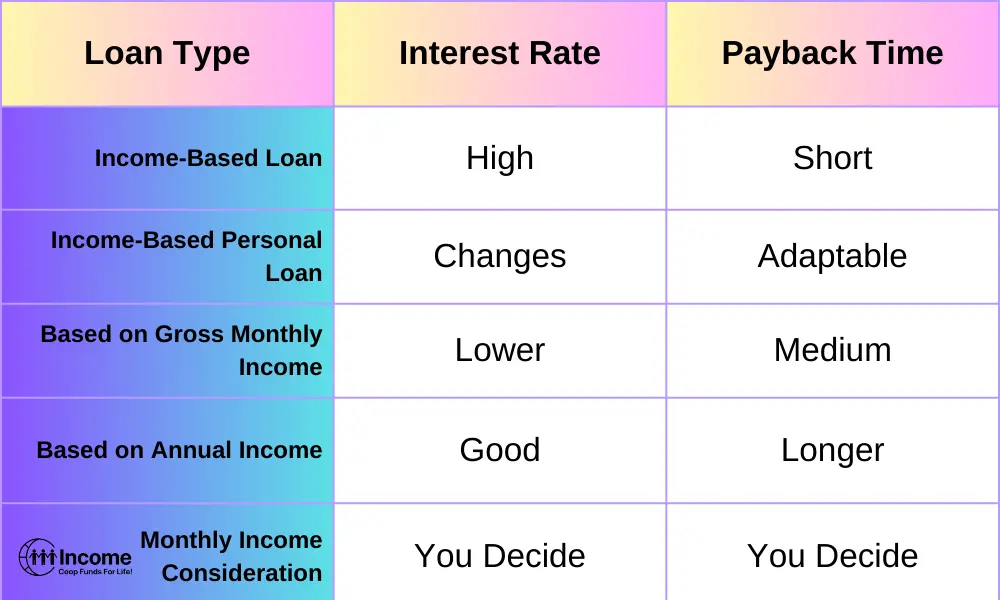

This table shows the hard truths about picking a loan. Each choice has a big impact. Income-based loans can look good because they’re easy to get, but beware! They have high rates and short payback times.

But, if you match your loan to your monthly or annual income, you can find a way to financial freedom, not a trap. Make a smart choice. Aim for a life where you can thrive, not just survive. This knowledge is priceless, so grab it and use it wisely!

StrategicBorrowing: Aligning Loans with Your Paycheck

Grasp the concept of StrategicBorrowing: Pairing your loans to your paycheck.

Get to know various loan types and how they affect your money matters. This is the first step towards strategic borrowing. It’s a clever way to match your loans with your paycheck, a vital move for sound finances.

- Find lenders who cater to low incomes. They’ll look at how much you earn and your credit record to check if you’re a good fit.

- Have your wage slips ready. They show how much you earn, a key detail in getting a loan approved.

- Pick a loan that lets you borrow cash without stretching your finances too thin. The repayments should go hand in hand with your income rise.

- Go for lenders who offer flexible terms for those with different income levels. This helps to avoid falling into debt.

Strategic borrowing is about making smart choices. It ensures that your ability to pay back the loan matches your monetary growth. It’s about gaining financial freedom, not just making a deal.

Loans based on income not credit: Navigating Loan Choices Wisely

Choosing the right personal loan can be tricky. But, don’t worry! Here’s a simple guide for you.

Make sure your loan matches your earnings. This way, it won’t feel like a heavy load but more like a helpful friend. How do you do this? Look closely at your credit history. It plays a big role in the kind of loan deals you can get.

Aim for a loan that grows with your income. It should help you, not hold you back. If you want to bring all your debts together under one loan, pick one that fits your financial picture perfectly.

Remember, loans are like shoes, they aren’t one size fits all. Your target should be a loan that suits your earning level and financial dreams.

By doing this, you’ll keep your peace of mind, avoid stress, and stay on the right path to reach your money goals.

Navigating High-Income, Low-Credit Scenarios

Are you stuck with a high income but a low credit score? Don’t worry! Income-based loans can be your solution. It’s hard when bad credit shrinks your choices, but your income shows you can manage the debt. Here’s an easy guide:

- Try Unsecured Loans: A great match for bad credit, these loans don’t need collateral. They look at your income, making them ideal for handling debt or other money needs.

- Choose Lenders with Soft Credit Checks: Some lenders use a soft check on your credit report. This won’t hurt your credit scores. It keeps your score safe while applying.

- Think About Income-Based Loans: These loans focus more on your income, less on your credit history. Perfect for high earners with poor credit.

- Plan for Better Credit in Future: Treat your loan as a stepping stone. Regular, timely payments can boost your credit score, giving you better loan deals later.

Don’t let bad credit pull you down. With the right steps, your high income can open doors to financial freedom!

Maximizing Income Growth to Pay Off Loans Quickly

Boost Your Income to Clear Loans Fast – Here’s How!

Want to pay off loans quickly and lessen your debt? The secret is growing your income! If you’ve borrowed based on your salary, a bigger income can help you settle your loans sooner. Let’s talk about how you can do this.

Ask for a pay rise, find more work, or hunt for better-paid jobs. Every step to grow your income helps you pay off your loans faster. Not only does this help keep your credit score healthy, but it can also lessen the interest you pay over time.

Paying off loans fast means more than just escaping debt early. It also means more money in your future to save, invest, or buy the things you love. So, boost your income, clear your loans fast, and start enjoying your money!

Avoiding Debt Spirals with Income-Adjusted Loans

Boosting earnings can make the debt-to-income ratio help pay off loans quicker.

Choosing loans adjusted to your income can stop you from sinking into debt. These loans fit your financial situation, making them a wise pick for handling your personal finance and money matters.

They match the loan amount and interest rates to your income, ensuring repayments are easy to manage.

This way, your credit score stays safe and you enjoy financial independence.

Here’s why loans adjusted to your income are a good idea:

- Easy repayments: Change with income shifts, stopping money worries.

- Less chance of not paying on time: Easy-to-manage payments mean less risk of falling behind.

- Keeps credit score safe: Regular payments help your credit history.

- Fits your needs: Stops you from borrowing more than you can afford, cutting debt risk.

Boost your financial freedom with income-adjusted loans!

How does income-based financing work?

Income-based financing is a smart way to borrow money. It adjusts the loan’s terms to your earnings, making your repayments affordable. It’s perfect if you want financial freedom when borrowing money.

With this type of loan, what matters most is your ability to pay back, not your credit score.

When you apply for this loan, you’ll share personal and financial details to prove your income. Lenders need this information to decide how much money you can borrow.

Your income determines your loan amount and terms, ensuring that your repayments won’t overwhelm you.

If you’re earning more money over time but need financial help now, this type of financing is perfect for you. It’s a wise way to borrow money without fear of debt.

You’ll borrow based on what you can afford to repay, matching your financial growth. This allows you to manage your money with confidence and freedom, putting you in control. It’s a valuable way to keep your finances in check.

Frequently Asked Questions

What Strategies Can I Employ to Negotiate Better Loan Terms Based on My Projected Income Growth?

To negotiate better loan terms based on your projected income growth, start by gathering evidence of your income trajectory, such as job offers or salary increase letters.

Present this to lenders to demonstrate your future ability to pay. Don’t shy away from shopping around and using offers from competitors as leverage.

Be clear about what you’re looking for in a secured loan, whether it’s a lower interest rate or more favorable repayment terms, and be prepared to negotiate.

How Can Income-Based Loans Impact My Long-Term Financial Planning, Especially Regarding Retirement Savings?

You’re considering how income-based loans might affect your future finances, especially saving for retirement.

It’s crucial to understand that while these loans can provide immediate relief or funding, they may come with high-interest rates, affecting how much you can save long-term.

Strategically, you’ll want to balance loan repayment with putting money into retirement accounts to ensure you’re not sacrificing future financial security for present needs.

Always aim to minimize debt’s impact on your savings goals.

Are There Specific Industries or Professions Where Income-Based Loans Offer More Advantages Due to the Nature of Income Variability?

Yes, loans based on income can be a game-changer if you’re in industries with fluctuating income, like freelancing, sales, or creative fields.

They offer flexibility, allowing you to borrow based on what you earn, not a fixed salary.

This means during high-earning periods, you might access more funds or better terms. It’s a smart move for managing cash flow and investing in growth opportunities without straining your finances.

Can Loans Based off Income Be Refinanced for Better Rates as My Income Grows, and What Are the Criteria for Such Refinancing?

Yes, you can refinance loans based off income for better rates as your income increases. The criteria for refinancing include a higher income, an improved credit score, and a history of on-time payments.

Lenders want to see that you’re more financially stable and can handle a new loan with potentially lower interest rates.

Research lenders who offer refinancing options and compare their terms to find the best deal for your growing financial situation.

How Does the Application of Income-Based Loans Differ for Self-Employed Individuals Versus Those With Traditional Employment?

When you’re self-employed, applying for loans based off income is a bit different than for those with traditional jobs.

You’ll need to provide more proof of your income, often through tax returns, bank statements, and sometimes, profit and loss statements.

Lenders want to see a steady income, which can be trickier to prove without regular paychecks. However, with enough documentation, you can still secure a loan tailored to your income levels.

Conclusion

Choosing income-based loans can align with your financial progress. As your income grows, repay your loans quicker for a healthier financial future.

Make smarter financial decisions with income-based loans. They factor in your income, not your past credit mistakes, making repayments manageable.

Use your income growth to pay off debt consolidation and off loans faster for improved financial stability.

Learn more at CoopInc to understand how you can leverage your income growth for better financial choices. Don’t miss out on this innovative way to boost your income!